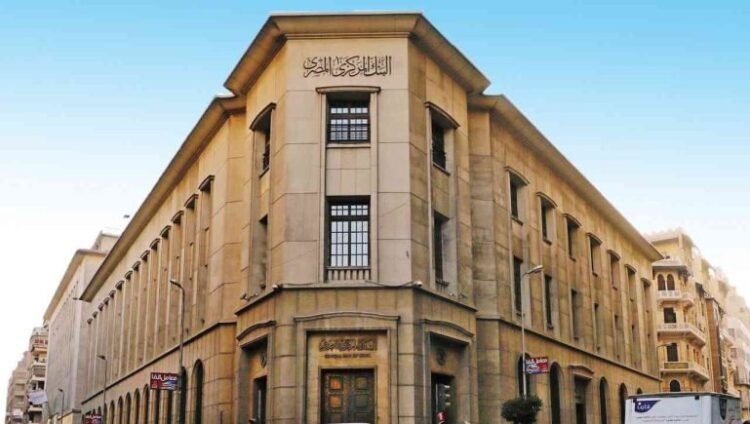

The recent interest rate hike by the Central Bank of Egypt has raised hopes of reining in Egypt’s runaway inflation and propping up the Egyptian pound that has been steadily losing value to foreign currencies. Nevertheless, the failure of recurrent rate hikes over the past year is feeding skepticism among some economists about the ability of the new rate lift to succeed while previous ones had failed.

“The latest rate increase cannot succeed where previous ones had failed because our government follows an expansionary policy, instead of the contractionary one it should be following,” Alia al-Mahdi, former dean of the School of Economics and Political Science at Cairo University, told Al-Monitor.

The Monetary Policy Committee, the decision-making body of the central bank, raised March 30 key interest rates by 2%, for the first time in 2023 and the fifth time since March of last year.

It raised the overnight deposit rate, overnight lending rate and main operation rate to 18.25%, 19.25% and 18.75%, respectively.

The central bank cited supply chain disruptions domestically, the depreciation of the Egyptian pound and demand side pressures to justify inflation rates.

It also referred to the seasonal impact of the Islamic month of Ramadan, noting that this had affected food prices.

Egypt’s annual headline inflation reached 31.9% in February, the highest in 5½ years, while core inflation jumped to a record 40.26% in the same month, according to the Egyptian government.

Food and commodity prices have been taking an unvarying upward trend for a whole year now, making it difficult for some Egyptians to cope and compelling Egyptian authorities to increase social and financial support to the most vulnerable members of society, for fear of a backlash from this deteriorating economic situation.

Two days after the central bank’s March 30 rate hike, the nation’s two largest banks — National Bank of Egypt and Banque Misr — offered two certificates of deposit with fixed yields of 19% and a decreasing yield of 22%.

The 18% yield certificates were an attempt by the nation’s banks to absorb excess liquidity in the market and rein in inflation, as Egypt tried to reduce effects from the painful blows it received from Russia’s war on Ukraine, a development that proved economically devastating for the populous, import-dependent Arab country.

Repeated depreciations of the pound caused it to lose over 50% of its value in the course of the past year.

Recurrent exchange rate pushups by the central bank aimed primarily to prop up the Egyptian pound against foreign currencies by creating demand for the national currency, even as they negatively affected investment and economic activities.

This is why some economists are questioning the logic of these rate increases, in light of past failures, especially when it comes to the failure of these rate hikes to bring inflation down.

This view is shared by the ordinary people who bought into the saving schemes of the local banks a year ago.

The repeated depreciations of the national currency mean that these people’s savings are being eaten away, especially with the interests on the saving schemes falling short of compensating this loss.

This is why some people say they will stay away from saving and start investing in value stores, such as gold, real estate and cars.

Mohamed Sobeih, an accountant in his mid-50s, put all his life’s savings into the 18% yield certificates of deposit almost a year ago.

He said that now his savings are down to half of their original value because of the devaluations of the pound. He told Al-Monitor that he will wait until his certificates mature before cashing them.

“I will then buy gold or real estate, instead of saving in the banks,” he added.

The failure of the new saving schemes to put money into people’s pockets, economists say, will translate into more demand for goods and services in the market.

“This increase in demand will raise the inflation rate even more,” Khaled al-Shafie, director of local think tank Capital Center for Economic Studies, told Al-Monitor.

There is, meanwhile, an increase in foreign currency deposits in the nation’s banks, probably reflecting declining confidence in the national currency.

This is why some people call for a more comprehensive policy to get Egypt out of its current economic crisis and help the members of the public protect their savings.